#anticipate : The Middle East’s Global Tripwire : wired for shock !

From Tehran and Tel Aviv to Riyadh, Doha and Abu Dhabi: how a Gulf rivalry and a few chokepoints bind Washington, Beijing, Istanbul and Moscow.

This post is relevant for anyone trying to understand the global implications of Middle East geopolitics in 2026, especially beyond simple alliance or conflict narratives. It’s best used as a strategic lens, not a sole authoritative source.

Think less “alliances” and more “plumbing.”

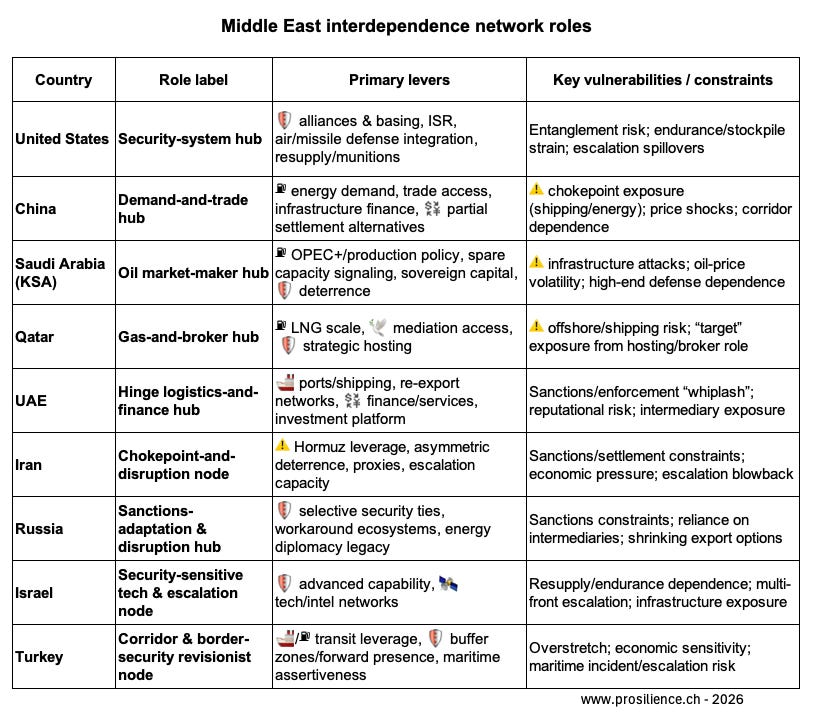

In today’s Middle East, leverage flows through chokepoints and connectors: Hormuz and the Red Sea lanes, sanctions and payment rails, and the logistics/finance hubs that keep trade moving. This network view explains why Iran-Israel escalation can ripple into global markets-and why Gulf dynamics matter beyond hydrocarbons: Saudi market-making, Qatar’s gas-and-broker role, Turkey’s corridor leverage, UAE hinge connectivity, and Russia’s sanctions-adaptation partnership with Iran can either dampen shocks or amplify them, all under the shadow of US security and China’s demand.

A drone strike, a ship seizure, a missile salvo-none of it has to close the Strait of Hormuz to shake the world. The moment insurers reprice risk, tankers reroute, and refiners scramble, a local security incident becomes an energy shock, then a market shock, then a political shock. That is the Middle East’s most consequential reality: the region’s strategic drama is tightly coupled to the global economy through a few critical routes and institutions. The chokepoints don’t just carry oil; they carry leverage. To see how power actually works across this system, it helps to stop thinking in bilateral “friend–foe” terms and start thinking like a network engineer.

A network lens: hubs, chokepoints, hinge nodes

In a network, hubs are nodes whose connections matter disproportionately-because they provide security guarantees, market access, finance, or critical technology. Chokepoints are narrow passages-physical (shipping lanes), institutional (sanctions and payment rails), or operational (airspace coordination)-where disruption cascades. And hinge nodes are connectors that keep flows moving between rival blocs, often by providing logistics, finance, and plausible deniability.

Using that lens, today’s architecture has three dominant patterns:

Two hubs: security remains largely US-centered, while trade and energy demand are increasingly China-centered.

One chokepoint: Hormuz is the system’s pressure valve—where Iran can create outsized global costs without winning a conventional war.

Adaptation under pressure: sanctions don’t stop flows so much as reroute them, deepening “workaround ecosystems”—especially in the Russia–Iran security-industrial loop.

Against that backdrop, Iran and Israel become more than adversaries; they become stress multipliers for a wider system run by hubs and chokepoints.

Read also The Saudi Arabia-UAE Dispute Is About More Than Just Yemen, by Foreign Policy, Jan 15, 2026

Spine #1: Two hubs, one chokepoint

The security hub: America is still the region’s operating system

Even after decades of “pivot” talk, the United States remains the Middle East’s most consequential security integrator: basing, command-and-control, intelligence, air defense interoperability, and resupply. A single example captures the structure: Qatar’s Al Udeid Air Base is described by Reuters as the forward headquarters for US Central Command and the region’s largest US base, with around 10,000 troops.

This matters because modern military capability is not a one-time purchase; it’s an ecosystem of training, spares, software, munitions, and doctrine. That ecosystem ties Gulf partners (KSA/UAE) and Israel—each in different ways—into US logistical and political decision cycles. The dependence becomes most visible in high-tempo conflict, when air defenses and precision munitions are consumed faster than peacetime procurement can replenish.

Israel is the clearest “hard link” in this network. The US–Israel 10-year Memorandum of Understanding covers $38 billion for FY2019–FY2028 (about $3.8B per year) in military assistance, anchoring Israel’s long-term modernization and procurement pipeline to US policy, budgets, and export licensing.

Interpretation: The US security hub creates deterrence and stability, but it also inherits entanglement risk: when Israel–Iran escalation threatens shipping or regional bases, Washington’s posture is pulled toward crisis management-even if it would prefer distance.

The commerce and energy hub: China is the demand center

China’s role is structurally different. Beijing is not the region’s main security guarantor; it is the demand-side gravity well. It buys energy, sells manufactured goods, builds infrastructure, and increasingly experiments with settlement mechanisms that marginally reduce exposure to Western financial chokepoints.

The Iran case shows the asymmetry. Reuters reported in mid-2025 that China purchases around 90% of Iran’s exported crude, equating to about 13.6% of China’s total oil imports in the first half of 2025, with independent “teapot” refiners central to the trade and frequent relabeling/transshipment through third countries.

Interpretation: Iran’s export revenue becomes unusually exposed to China’s demand, shipping access, and enforcement pressure; China’s exposure is broader and more substitutable-except where geography forces dependence.

The chokepoint: Hormuz turns regional conflict into global pricing

That geography is the Strait of Hormuz. The US Energy Information Administration estimates that in 2024 and early 2025, flows through Hormuz represented more than one-quarter of total global seaborne oil trade and about one-fifth of global oil and petroleum product consumption; roughly one-fifth of global LNG trade also transited the strait in 2024.

EIA also estimates that 84% of crude/condensate and 83% of LNG passing Hormuz went to Asian markets in 2024, with China, India, Japan, and South Korea the top destinations.

Pipeline bypass capacity helps-but only partially. EIA estimates about 2.6 million b/d of Saudi and UAE pipeline capacity could be available to bypass Hormuz in a disruption scenario, and notes the UAE’s 1.8 million b/d pipeline to Fujairah as a key route-still far below the strait’s scale.

Interpretation: Hormuz is Iran’s asymmetric lever because it links the two hubs: the US must keep routes open for security credibility; China must keep them open for economic continuity. The Gulf states sit in the middle-earning revenue from flows they cannot fully reroute.

If you did not read it yet

Spine #2: Hinge nodes and sanctions friction

Sanctions are not a wall; they are system friction

Sanctions rarely “stop” trade cleanly. More often they raise the cost of doing business: fewer banks will touch a payment; fewer shippers will insure a route; more documents must be laundered through intermediaries; more parties fear secondary exposure. The cumulative effect is a drag on the sanctioned state—and a new form of leverage over everyone in the chain.

US Treasury has emphasized expanding tools that create secondary sanctions risk for foreign financial institutions that support Russia’s military-industrial base, illustrating how enforcement targets connectors, not only principals.

The UAE as a hinge node: powerful - until it becomes a point of failure

Hinge states thrive because they provide high-trust logistics and finance in a low-trust environment. The UAE-by virtue of shipping, re-export, financial services, and geographic placement-has become a quintessential hinge node, which also means it faces pressure when enforcement tightens on transshipment and third-country enablement.

Interpretation: In network terms, hinges are “high betweenness centrality” nodes: they don’t have to be the biggest economy or the strongest military to matter. When they are squeezed-through compliance actions, designation campaigns, or reputational shocks-the disruption propagates far beyond the original target.

Saudi Arabia (KSA) : the market-making hub with security depth

KSA functions as a system hub in two ways. First, it is an oil market-maker: through OPEC/OPEC+ leadership and spare capacity dynamics, Saudi decisions influence global price stability and therefore inflation, interest-rate expectations, and political risk far beyond the region. Second, it is a regional security heavyweight whose deterrence posture—especially air and missile defense—interlocks with the US security architecture. This is where KSA’s “hub-ness” becomes sticky: air defense systems, interoperability, training, and resupply create long-cycle dependencies that are difficult to rewire quickly.

Interpreation: when threats rise (Iran-linked attacks, maritime risk, escalation around Israel, Somaliland), KSA tends to behave like a risk manager - trying to dampen instability that could endanger infrastructure and investment confidence - while preserving the capacity to escalate if core security is threatened. In other words, Saudi Arabia is a hub that prefers managed volatility, because its domestic transformation agenda depends on predictable capital conditions.

Qatar: a gas chokepoint-adjacent hub and diplomatic connector

Qatar’s structural power comes from being both indispensable infrastructure and indispensable diplomacy. On energy, Qatar is a global LNG superpower; its North Field expansion trajectory makes it a key “release valve” for future gas market tightness. On security, Qatar’s hosting of Al Udeid anchors a major portion of US operational reach—making Doha a critical node in the US security network, even though Qatar is not a classic military heavyweight. On politics, Qatar’s comparative advantage is brokerage: it maintains channels to actors others often can’t-or won’t-engage, and it converts that access into influence.

Interpretation : Qatar is best understood as a connector node with high “broker value.” It can reduce friction in crises by keeping negotiating channels open—but it also absorbs “blowback risk,” because hosting strategic assets and mediating in high-stakes conflicts can make it a symbolic or operational target.

Alternative rails: not a dollar replacement, but meaningful at the margin

Financial fragmentation is the second kind of chokepoint politics. The trend is not that the dollar disappears; it is that some corridors become marginally more resilient.

An EY report summarizing Chinese sources notes that CIPS (China’s Cross-Border Interbank Payment System) processed RMB 175 trillion in 2024, up 43% year-on-year, reflecting sustained growth in RMB settlement infrastructure.

PBOC reporting also documents large and growing CIPS transaction values in 2024.

Interpretation: This does not eliminate sanctions leverage, but it can reduce it at the margin-especially for sanctioned trade that can tolerate complexity, opacity, and higher transaction costs.

Turkey: a regional hinge node & high leverage connector

Turkey’s Middle East posture has crystallized into two mutually reinforcing roles. First, it acts as a regional hinge node, linking Gulf capital with Eurasian supply and European demand. Ankara leverages its geography across energy and trade corridors, promotes itself as a logistics and transit platform, and uses diplomatic normalization - especially with Gulf states - to attract investment, tourism, and financing during periods of domestic economic strain. Second, Turkey operates as a border-security revisionist, shaping realities through forward deployments and buffer-zone strategies in northern Syria and northern Iraq, while pushing expansive maritime claims under the “Blue Homeland” doctrine and partnerships in the Eastern Mediterranean and Libya.

In the wider hubs-and-chokepoints system, Turkey is neither the primary security hub (the US) nor the main demand hub (China), but it is a high-leverage connector. That increases its bargaining power-yet its forward posture and maritime assertiveness also raise regional volatility, turning disputes into potential security and energy-price shocks.

Interpretation : Turkey’s “hinge + revisionist” posture is essentially a strategy of strategic autonomy through leverage: Ankara tries to be indispensable as a corridor state (energy, trade, finance linkages) while simultaneously shaping its security perimeter via buffer zones and maritime assertiveness. The payoff is bargaining power with multiple blocs at once; the cost is higher volatility and recurring friction, because the same forward posture that creates deterrence also increases the risk of escalation and pushes partners to build bypass options over time.

Spine #3: Adaptation under pressure

Russia–Iran: a sanctions-adaptation loop hardens into structure

The most visible adaptation loop links Russia and Iran: battlefield demand, sanctions constraints, and technology transfer converge into a security-industrial corridor.

Reuters reported Ukraine’s claim that Russia had launched thousands of Iran-developed Shahed drones during the war and that reports indicated Russia was also manufacturing them domestically using Iranian technology. The International Institute for Strategic Studies describes how Iran began supplying Shahed-131/136 one-way attack UAVs in 2022 and how the relationship evolved toward domestic Russian production.

Meanwhile, the relationship is being formalized politically. Iranian government sources published the text of a Comprehensive Strategic Partnership signed on January 17, 2025; Russia’s Foreign Ministry has also referenced the agreement’s entry into force. And cooperation spans “dual-use” domains like space: AP reported Russia launched three Iranian satellites into orbit in late 2025, highlighting the broader strategic tie.

Interpretation: This is what adaptation looks like when it becomes durable. Sanctions pressure pushes partners into deeper technical interdependence-precisely because their alternatives are limited.

OPEC+: economics as a geopolitical backchannel

Not all leverage is military. Oil coordination remains a strategic instrument—and a diplomatic channel. OPEC’s “Declaration of Cooperation” formalized the OPEC+ framework that underpins production coordination between Saudi Arabia and non-OPEC producers including Russia.

Interpretation: OPEC+ is a stabilizer (prices and planning) and a backchannel (ongoing bargaining). It can align Saudi and Russian interests in ways that periodically diverge from US preferences, reinforcing the “two hubs” reality: Washington may anchor security, but it does not fully control market governance.

Israel : a security-sensitive tech node

Israel is tightly coupled to the US security hub, but it is also economically integrated with China-under a growing security filter. China’s Ministry of Foreign Affairs reports $22.7B in China–Israel trade in 2024.

Israel’s Institute for National Security Studies notes that China remained Israel’s largest goods import source in 2024 and that China’s share of Israeli goods imports was substantial.

At the same time, Israel has institutionalized scrutiny. Israel’s government describes an advisory mechanism to evaluate national-security implications of foreign investment; UNCTAD and Israeli security-policy analysis date the creation of this committee to October 30, 2019.

Infrastructure highlights the tension: Israel granted Shanghai International Port Group a long concession to operate Haifa’s new Bay Terminal starting in 2021, a deal that became emblematic of the “economic upside vs strategic exposure” debate.

Interpretation: Israel’s position is not “choose China or the US.” It is: capture trade gains while ensuring the security hub (the US) does not view economic integration as strategic vulnerability.

Russia–Israel: deconfliction as a relationship

Even amid deep strategic mistrust-especially given Russia–Iran ties-Israel and Russia have maintained operational channels to avoid accidental clashes in Syria. Reuters reported in 2015 on the establishment of a “hotline” and related coordination mechanisms.

Interpretation: Networks preserve functional links even when political alignment fails. Deconfliction is not friendship; it is plumbing.

What to watch: early indicators before the network snaps

1) Maritime chokepoints and shipping risk

Hormuz risk premium: war-risk insurance quotes, tanker freight spikes, naval alerts, AIS spoofing/jamming, sudden “dark” shipping clusters.

Red Sea / Bab el-Mandeb diversion rate: sustained rerouting around the Cape, convoy behavior, port congestion in the Med/Arabian Sea (signals spillover from Yemen/Horn dynamics).

Critical port/terminal disruptions: Fujairah loading patterns (UAE), Ras Tanura/Jubail signals (KSA), and any repeated interdictions or “board-and-search” incidents.

2) Energy shock indicators

Oil: OPEC+ cohesion signals (KSA as market-maker): surprise voluntary cuts/extensions, baseline disputes, compliance chatter, or wording that increases “optionality” (pause/reverse language).

Gas: Qatar LNG stress signals: North Field timeline slippage, force majeure chatter, offshore security incidents, and sharp moves in LNG spot benchmarks (JKM) tied to Gulf headlines.

Shared-field risk (Qatar–Iran): any incidents affecting Iran’s South Pars side (even if Qatar’s side is untouched) — markets price perceived shared-infrastructure risk quickly.

Turkey as corridor gauge: unusual moves in pipeline flows or contracts (TurkStream/TANAP), “energy hub” announcements, or politicized transit talk—signals corridor leverage being activated.

3) Sanctions, enforcement, and hinge-node friction

Sanctions targeting connectors (UAE focus): new designations of traders/shippers/banks, compliance advisories, sudden bank “de-risking” (accounts closed, letters of credit tightened).

Trade controls tightening: export-control expansions on dual-use components (electronics, machine tools) that feed Russia–Iran production loops.

Settlement fragmentation: RMB invoicing pushes, CIPS usage headlines, and corporate/bank compliance memos that signal a shift from “workaround” to “policy posture.”

4) Military posture and escalation temperature

US force posture signals (Gulf + Qatar): unusual movements around major hubs (e.g., Al Udeid/other regional facilities), air defense deployments, heightened base threat conditions.

Israel–Iran escalation ladder: interceptor/munitions consumption signals, emergency procurement/drawdown talk, and any expansion of target sets that would implicate shipping lanes or Gulf infrastructure.

Russia–Iran tech deepening: evidence of scaled UAV/munition production (facility expansion, component procurement patterns, new co-production arrangements), plus any “dual-use” cooperation announcements.

5) Gulf politics and rivalry as a shock amplifier (KSA–UAE–Qatar)

Saudi–UAE rivalry temperature: policy moves that weaponize “hub competition” (HQ rules, trade restrictions), or proxy-arena frictions (Yemen/Horn/Sudan) that can spill into Red Sea risk.

Qatar mediation viability: whether Doha remains accepted by multiple sides (or gets publicly delegitimized). Loss of broker credibility is a leading indicator that conflicts will last longer and escalate faster.

KSA de-escalation track health: breakdowns in dialogue with Iran or spikes in missile/drone threats to Saudi infrastructure—often the earliest signal that risk appetite is changing.

Conclusion - What if not : the cascade decade

If the system doesn’t get rewired—if everyone keeps treating this as a set of bilateral disputes rather than a coupled network…

A “minor” incident becomes the first true supply-chain war at sea. Not a Hormuz closure—just enough drone strikes, seizures, spoofing, and insurance repricing to make energy and container shipping structurally more expensive. The Gulf doesn’t stop exporting; the world just pays a permanent volatility tax.

The Gulf fractures into competing hubs, not a stabilizing bloc. Saudi Arabia and the UAE harden their rivalry into policy: rival logistics corridors, rival financial compliance regimes, rival proxy bets (Yemen/Horn/Sudan). Instead of absorbing shocks, the Gulf starts producing them—because coordination collapses when it’s most needed.

Sanctions mutate from a tool into a climate. Enforcement expands from targets to ecosystems: traders, insurers, banks, ports. Hinge nodes (UAE and others) over-correct, trade finance becomes episodic, and global commerce adapts by building parallel corridors that are slower, pricier, and more opaque.

A fragmented payments world becomes normal. RMB/CIPS and other alternatives don’t dethrone the dollar—but they create just enough insulation for sanctioned corridors to persist. The result isn’t de-dollarization; it’s de-transparency: higher friction, weaker monitoring, and more room for gray-zone statecraft.

Russia–Iran becomes a durable “workaround bloc.” What began as wartime expediency hardens into co-production, dual-use tech exchange, and deterrence by disruption. That raises the baseline capability for cheap strikes—and lowers the threshold for using them.

Qatar’s LNG and mediation become a single point of failure. If Doha loses broker legitimacy or its export system is credibly threatened, gas markets reprice globally. LNG becomes the new “canary,” with price spikes arriving faster than diplomacy.

Turkey turns corridors into bargaining chips. If Ankara politicizes transit and maritime posture while simultaneously pushing buffer zones, it becomes both indispensable and feared—driving others to build bypasses while raising the risk of naval incidents in contested waters.

Israel–Iran escalation becomes periodic rather than exceptional. Not one war—recurring cycles that burn interceptors, strain resupply chains, and repeatedly test US posture. Each cycle bleeds into shipping risk and energy pricing, and each makes the next one easier to trigger.

End state: the Middle East doesn’t “explode”—it recalibrates into a world where every crisis is priced in advance and resolved late. Markets adapt, governments harden, trade reroutes, and the cost of moving energy, goods, and capital rises structurally. The region becomes not a battlefield of armies, but a switchboard of systemic disruption—where the biggest weapon is not conquest, but the ability to make the global economy flinch on command.

Sources.

Stellar analysis on how treating geopolitics like network architecture reveals dependencies that traditional alliance-framing misses. The hinge node concept is really smart becuz it explains why UAE pressure cascades so unpredictably into global supply flows, even thoug they're not the biggest player. Back when I was studying logistics disruption patterns during the pandemic, we saw how chokepoints become leverage points not through closure but through insurance repricing and route uncertainty. The part about sanctions creating friction rather than walls is something we underestimate constantly in system planning.